The Amazon (AMZN) AWS public cloud offering has set the stage for a massive transformation of enterprise IT from being premise-driven (servers, switches, data centers, etc.) to being services driven (APIs, services, consoles, etc.). This transformation promises to produce a new crop of winners and losers.

2014 should be a pivotal year in the emergence of hybrid cloud, as Microsoft (MSFT) and VMware (VMW) enter the cloud space with their own offerings, and compete directly with Amazon for the $1 trillion+ enterprise IT market once protected by moats of complexity, specializations and proprietary hardware. Those moats once protected and sustained dozens of large cap technology companies from legions of emerging companies who simply couldn't achieve critical mass with available resources. Amazon is in the process of destroying those moats.

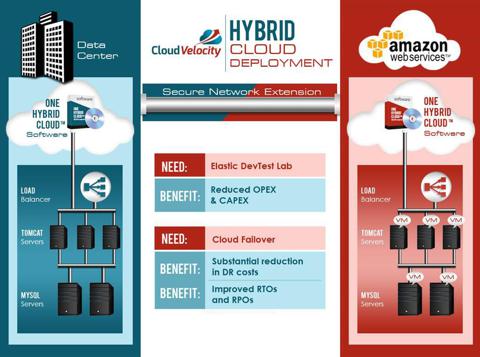

The next trigger should be the evolution of hybrid cloud automation, or the ability for apps and services to easily move from facilities into clouds and ultimately between them. Leveraging the cloud for "pay as you go" disaster recovery and agile DevTest can be faster and more efficient than most comparable legacy approaches locked into a vendor or a facility or even a cobbled collection of legacy facilities. It would accelerate the shift to cloud for enterprise production apps.

The following is a hybrid cloud architectural diagram courtesy of my employer (CloudVelocity):

It is all about agility, protection and efficiency, at levels practically impossible in virtually every firm that has made substantial IT investments over the last few decades. Dedicated, specialized hardware has become the problem rather than the solution, especially when it comes to agility and ongoing operating costs in increasingly complex environments.

Kepes: Agility and Mobility is becoming the New Normal

For reference see this recent Forbes article by Ben Kepes: Do Containers Mark the Death Knell for Virtualization? Ben, a leading cloud blogger and expert, who discusses the tradeoffs between bare metal and virtualized servers for enterprise agility and flexibility, a debate that might have been unthinkable as recent as five years ago. His summary nails the core sentiment.

We're in both a macro paradigm shift and a micro one. The macro one takes us to a world where agility, flexibility, mobility and the cloud are the norms. - Ben Kepes, Forbes, Dec 10, 2013

Indeed, the monetization of complexity that drove the massive creation of market caps in the networking, server and software industries is being replaced by increasingly service-centric products that deliver APIs (application program interfaces) from the cloud. The result of the emergence of services versus racks is heightened agility, protection and efficiency, not to mention the ability of IT teams to focus on new product and service development versus routine maintenance.

IT becomes even more strategic to the business, and more closely aligned with product development and marketing as cloud providers build powerful services that simplify tasks and increase efficiencies.

This is not a subtle shift for an industry once dominated by the massive pools of technical expertise and the manual steps required to simply add a server into a large network. Colocation vendors thrived because they could enable growth and change faster and cheaper than many organizations. Yet that world is changing.

Colocation and the Cloud Transformation

Thus far, Amazon has dominated the IaaS cloud market, per this (and other) recent Seeking Alpha cloud infrastructure market report, based on a Synergy Research report cited in GigaOm.

By Synergy's measure, total IaaS/PaaS revenues for the quarter passed $2.5 billion with IaaS making up 64 percent of the total. Within IaaS alone, AWS accounted for 35 percent of the market; IBM 7 percent; and "everyone else" less than 3 percent each. In PaaS, Salesforce.com-with its Force.com and Heroku soon to be joined by Heroku1-had an 18 percent share; AWS 17 percent; Microsoft 14 percent; Google 13 percent; and everyone else less than 5 percent each.

Beneath the surface of the Amazon-led IT transformation is the murkier story: that is, what happens to all of the business models that came of age in the hardware specialization era, which tied their growth and profits to the once accelerating demands for increasingly powerful and robust hardware and the services required to support increasingly complex and costly data centers?

The Colo Challenge

That takes us to a host of colocation companies that acted as safety valves for the once accelerating gap between operating demands and internal resources. Compare these two observations from the report:

1) Synergy thinks the traditional Web hosting market, which Rackspace remains well-exposed to, and which has been pressured by the IaaS market's rise, only grew 3% Y/Y in Q3.2) Altogether, Synergy thinks Amazon grew its IaaS/PaaS revenue by 55% Y/Y, outpacing the 46% growth seen by the overall market. Moreover, AWS' IaaS/PaaS revenue is believed to have eclipsed that of Microsoft, Google, IBM, and Salesforce combined.

Amazon could be impacting a sector which has had impressive growth in recent years (as reported in Data Center Knowledge), and was looking at expansion as late as 2011 based on solid research tracking the need for enterprises to outsource operations to third parties:

Roughly 8.75% of total enterprise data center space is currently in colocation. That total will increase to 14.11% by 2015.

Nemertes nailed the trend and naturally thought of the colocation providers as the beneficiaries, as the industry as a whole did. Yet the cloud providers may be capturing a market once owned by the colo players. IaaS revenues in 2011 were hardly measurable in proportion to colocation revenues, and are still perhaps a small portion. Yet the contrast in growth rates has to give pause to the third party data center industry and the ecosystem of vendors who support them. After all, the cloud is the ultimate third party data center.

Two years later, it appears that Amazon and IaaS has impacted the growth in the colo market, starting with small and new apps and now expending to traditional production workloads. I too have been a public cloud protagonist, equally surprised by what has been accomplished in a very short time.

It could get even worse for the colocation industry: along come Microsoft with Azure and VMware with vCloud in 2014 with a new surge of competitive offerings. That means more APIs and services; and fewer hardware-driven headaches for enterprises seeking agility over ownership.

The Two Stage Predicament

Data center development isn't like software where copies are easily made and distributed on demand. Data centers can take years to develop, from start to finish. Could it be possible that, based on 2011 assumptions, colo providers have made investments in data centers based on 2011 sentiments and that some of those facilities have yet to come online? That would mean sizable capital investments made in advance of declining growth rates.

That could set up a two-stage problem, whereby: 1) AWS, Azure and vCloud drive prices lower based on $50B/year in competitive data center infrastructure as a service investments; then 2) excess data center capacity among the traditional players drives them even lower.

The data center colo industry could become like the airline industry, with massive capital investments chasing margins and growth, mostly via consolidation.

Those who simply chased REIT status by focusing on real estate versus services and software and APIs could be rendered irrelevant. What happens to a CAPEX-driven industry when growth rates go from 20% to 3%? We may soon find out.

Consolidation Pressures

I suspect that we will see massive consolidation down to perhaps two dozen players who will earn their positions through superior service, customization, specialization (compliance, security, software, big pipes, etc.), customer loyalty or perhaps scalability and energy efficiency. The generic colocation player without competitive differentiation then becomes a commercial real estate play with assets valued more like climate-controlled warehouses versus information-age factories.

Looking to 2014-2016 it looks like we are gazing at a massive IT transformation and a cyclical rotation of winners and losers on perhaps a scale we haven't seen, yet was predicted in Nick Carr's classic The Big Switch in 2008. Stay tuned.

Additional disclosure: CloudVelocity is an Amazon AWS and Microsoft Azure partner.

No comments:

Post a Comment

Please see our site at lkconsulting.net